Gold to Silver Ratio & Consumers Vote with their Wallets. Where's the Silver Summit? North of $125

- WorldNews

- Jan 29, 2022

- 3 min read

Updated: Feb 1, 2022

The most frequent internet searches in the precious metal space are:

Comparing prices between dealers.

Searches that source global regions that mine silver and gold. The search goes like this, "The world's top 10 largest silver mines"

Searches surrounding price. The specific search, "How much is 1 Oz. of silver today?" Here is a Live Silver Price.

But over the last 3,000 years this writer believes people want to understand the purest gold to silver ratio. A ratio that is grounded in economic and mathematical fundamentals. It becomes a study of scarcity. The Law of Scarcity simply states: If what we desire “appears” to be in limited supply, the perception of its value increases significantly.

Last week we dove into this topic by analyzing the following:

1. What is the comparison between silver and gold above the ground? Total Above Ground Supply of silver , 850.5 metric tonnes

Total Above Ground supply of gold, 201 metric tonnes.

The ratio between Gold and Silver in "above the ground" terms.

Numbers are inverted because there is more silver than gold above the ground so there is 4.2 times more silver than gold above the ground. This gold to silver ratio is only 4-1.

2. How much has been mined comparing silver to gold? 198,000 metric tonnes of gold have been mined over time according to the World Gold Council. Estimates state that during this same time about 1.74 million metric tonnes of silver have been mined. The ratio between the two can be stated that in ounces, silver has been extracted 8.8 times more than gold. This gold to silver ratio is 9-1.

On Saturday January 29 gold is $1,793.37 per ounce. Silver is $22.55 per ounce. This represents a gold to silver ratio of 79.5.

Today is r/wallstreetsilver's 1 year anniversary. The movement is closing in on 200,000 members and has the most street credibility. This is grassroots & more legit than the same ol' silver troopers ... Rick Rule, David Morgan, Andrew Maguire, Alasdair Macleod, et al.

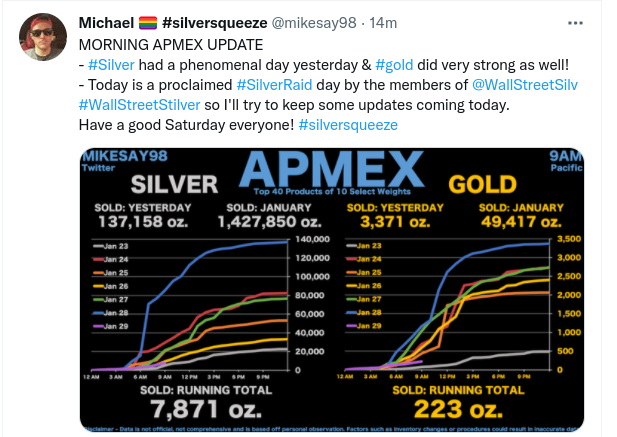

The purpose of today's silver news article is a snapshot capturing all of January's sales at APMEX which is a top 3 bullion dealer in USA. The "go to" on this data point is https://twitter.com/mikesay98. Here is his tweet this morning (Silver Raid Day) discussing APMEX silver sales for the month. He also posts gold sales for the month.

The ratio calculated in ounces.

29 times more silver purchased than gold. Understanding this is only 1 Bullion dealer I would bet on a stack of bibles that these numbers portray the averages of Apmex, JM Bullion, SD Bullion, SilverGoldBull, Monument Metals, BullionMax, Money Metals.

Averaging aforementioned 3 data points together.

Comparison between silver and gold above the ground 4.2 to 1

How much has been ever mined 9-1

How much was purchased in January 29-1

In averaging the 3 data points the Gold to silver ratio is 14-1.

A telling number because this ratio is exactly the same number that was placed into law back before all the fuckery stemming from bankers like J.P. Morgan and Bank of America. Moreover in ancient times when people were smarter than TheFed, JPM, BofA, #KitcoSucks a years wage was an ounce of gold and a month's wage was an ounce of silver. Thus 12 -1 Gold to silver ratio

In conclusion.

The criminal cartel (Again JPM, BofA, Comex, TheFed) has fucked up the PM market. But this is very good news and poses a huge opportunity even for this stupid ape.

So gold is $1,793.37 per ounce. Silver is $22.55 per ounce. This represents a gold to silver ratio of 79.5 but all the research points to a true GSR of 14. This means that if you invest $1,000 in silver you obtain 44 ounces of silver. When silver comes back to a fair value (a return GSR of 14-1) then this will climb by a magnitude of 5.7.

Thus your $1000 investment will climb to $5,700.

UPDATE - based on the comments that have flooded our inbox some miners, junior miners and bullion dealers believe the GSR is closer to 12-1 and some have it as 8-1, thus an average of 10-1

Keith Neumeyer CEO of First Majestic discusses the gold to silver mining ratio which had traditionally been at 13-1, now down to 8-1 and moving even lower. Watch Jim & Ivan's interview at the 4:33 time mark:

Graphics below:

Website that researches best pricing on silver and gold

Follow Mike on Twitter @mikesay98

Comments