Rick Rule Attacks Trudeau's Executive Decree While Making the Strongest Case for Gold.

- Silver Soaring

- Feb 20, 2022

- 5 min read

Updated: Jun 23, 2023

Rick Rule's analysis is the best I've heard using business and economic analysis. He lays it out convincingly. His reasons are easy to understand, rooted in common sense and this content is the wake up call citizens desperately need to hear.

We spent considerable time listening to the interview and this is the best paraphrasing possible. Rick Rule says, "The reason why Gold will move much higher in price revolves around the deteriorating confidence that savings and investors have in savings and investment products denominated in fiat currencies namely the U.S. dollar.

The first big problem is quantitative easing. Quantitative easing is counterfeiting..."money printing." If you did this you would go to prison. But if you are a congressman QE becomes policy and you'd be re-elected. (because voters don't understand what's really been happening to their detriment.)

More than 35% of all U.S. dollars in circulation have been newly created in the last 30 months but there hasn't been a 35% growth in the U.S. economy. Quantitative easing is creating currency out of thin air.

They're issuing specious and worthless currency units and by definition debasing the existing stock of currency that by itself might give somebody concern about the efficacy of the purchasing power evidenced by U.S. dollar nominated securities but it gets worse.

Debt and deficits, we've now passed $30 trillion dollars in on-balance debt. Moreover, we have well in excess of $120 trillion dollars in net present value of off balance sheets (social security & medicare entitlements )

So in adding these two figures we have almost $150 trillion dollars in

debt or liabilities which we pretend to service with a budget that's $3 Trillion dollars a year. The debt is not going to be paid. it's going to be rescheduled. That too should make you nervous about your purchasing power in U.S. dollars. But it gets worse.

We have negative real interest rates. The idea that you should forestall consumption as a saver, lend your money to somebody who consumes now in preference to you, take the credit risk of their ability to pay it back, while accepting back payment that is less than what you offered up is truly insane.

The arithmetic around the U.S 10-year treasury boggles the mind. The government purports to pay you 2% percent, which they will because they can print, in a currency while the purchasing power is depreciating 7.5% a year. The value of this investment is easy to calculate. You take the 2% number and you subtract 7.5%.

The U.S. government guarantees to reduce your purchasing power by 5.5% a year compounded over 10 years. This is truly insane.

Two more reasons why the precious metals prices will go up. The first is the extraordinarily low market share that precious metals occupy among savings and investment assets. Savings in gold and silver in the United States is less than one half of one percent. This is down from a three-decade mean of between 1.5% and 2%.

Red flags or concerns over quantitative easing, debt and deficits and negative real interest rates will spark a stampede of new funds into gold & silver. Even to the minimum extent expected to meet the three decade mean translates into tripling or quadrupling buying pressure.

Everything stated above are massive bullish signals for gold and silver but what I'm about to say could be the largest driver of all.

Traditional institutional investors worldwide have been operating under 40 years of falling interest rates. We're talking about the biggest investors in the world. The sovereign wealth funds, the pension funds the insurance companies. They've adopted a strategy of 60% debt 40% equity. Basically, these institutional investors are between the same rock and the same hard spot that The Fed is.

The 40% of their portfolio they count on for stability guarantees them a loss, guarantees them the inability to fund the pensions that they are required to fund, guarantees them the inability to honor the life insurance settlements which will come from life insurance policyholders, guarantees them the inability to fund the continued operation of the universities whose endowments are invested like this.

Even junk bond holdings, the junk bond index right now yields 4.7 percent against a currency that's depreciating by 6.5%. You take credit risk and you still lose 1.5% compounded and this is assuming that everybody pays you back which is a very poor assumption.

Here are the 5 reasons Gold and Silver will Spike.

Quantitative Easing. More than 35 percent of all U.S. dollars in circulation have been newly created in the last 30 months.

Debt & Deficits. Over $150 Trillion, combining balance sheet and unfunded liabilities, against only $3 Trillion in revenue per year.

Negative yield. T-bonds pay 2%, subtract inflation yields a guaranteed loss of 6% or more.

Current investment in Precious Metals is one half of one percent and the historic mean is 2%. Returning to historic mean would be the quadrupling of buying pressure.

Institutional investors that have to fund sovereign governments, retirement funds, life insurance policies and universities can not follow a strategy that offers guaranteed losses.

In the video Rick Rule goes on to voice severe concern over the executive decree by Justin Trudeau which included seizure of bank accounts, cancelling insurance policies and seizing crypto.

[ end of Rick Rule segment, the remainder of the article is PickAxe editorial ]

GEOPOLITICAL SNAPSHOT, Russia vs USA

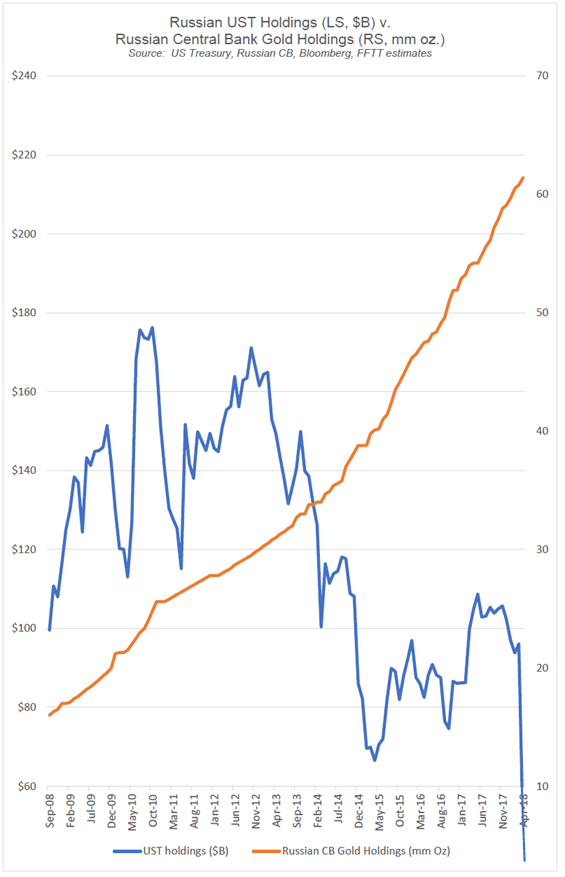

You've heard about the Golden Rule, "He who has the gold makes the rules." - Look what Russia's been doing for past 8 years. They don't purchase US Treasury Bonds. Instead, their central bank purchases gold. Look at the divergence in one chart.

chart tweeted out by @LukeGromen

The PickAxe pivots to investigating the spurious origins of Trudeau vowing to 1.) Seize bank accounts 2.) Seize crypto and 3.) Cancel insurance policies for peaceful protests in Canada.

Beginning the week of February 14, 2022 Justin Trudeau and Chrystia Freeland, The Prime Minister and Deputy Prime Minister of Canada bypassed the courts in response to peaceful protests organized by truckers. Through an executive decree, Trudeau and Freeland vowed to seize bank accounts, cancel insurance policies and seize cryptocurrency wallets for anyone affiliated with protests including people who gave donations to the protest. There has been no looting nor buildings burned.

In any investigation one must follow the money by digging into Trudeau and Freeland's sphere of influence. Let's learn more about Justin Trudeau and Chrystia Freeland's affiliations. Prime Minister Justin Trudeau, member or graduate of the World Economic Forum

Deputy Prime Minister Chrystia Freeland, member or graduate of the World Economic Forum

Crypto currency wallet platform (BTC, ETH) in joint venture with World Economic Forum

World Economic Forum members or graduates, Prime Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland melting in each other's arms. When optics match reality.

There is an old saying that goes, "When someone shows you who they are, believe them."

When Trudeau vowed to seize bank accounts, cancel insurance policies and seize crypto wallets, this sparked #bankrunCanada trending on social media. It wasn't just a trend on social media, ATM's ran out of cash and banking websites went offline.

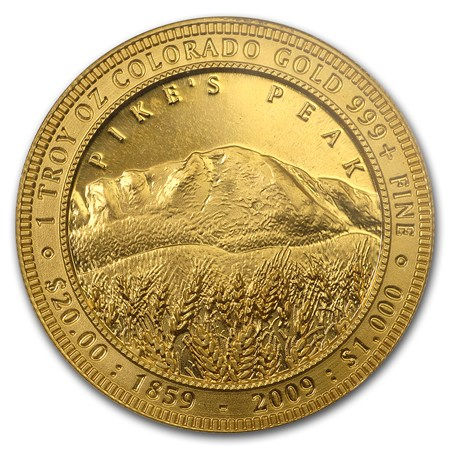

The silver lining of Trudeau's Martial Law ( seizing bank accounts, seizing crypto) is the stampede effect. People the world over are moving savings into safe havens like silver and gold bullion.

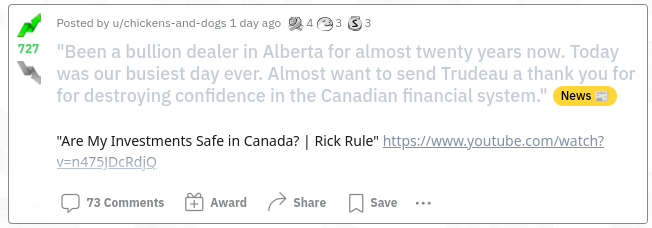

This post above was on Reddit's WallStreetSilver and posted by the owner of Jaxville, a Gold and Silver Bullion dealer in Red Deer Alberta, Canada.

Rick Rule segment snipped from Liberty & Finance Gold & Silver Bullion Brokers YouTube channel.

https://www.youtube.com/c/LibertyandFinance/videos

There are other parts of the video that were edited based on facts gathered from various sources such as other publications, the World Economic Forum's own website & Reddit.

Comments