Soldiers, Shields, Spears & Bombs. Silver, Gold, Oil & DEBT.

- Silver Soaring

- Mar 22, 2022

- 9 min read

Updated: Apr 27, 2022

March 22, 2022

Precious Metal Warfare Theory Gold and Silver coins were first developed in Lydia around 600 BCE The very first gold coin minted was called the Lydian Stater and dates back to the second half of the 7th century BCE, during the reign of King Alyattes (r.619-560 BCE)

Lydia was an Iron Age kingdom of Western Asia Minor located east of ancient Ionia in the modern Western Turkish provinces of Uşak, Manisa and inland Izmir.

During this same century a popular silver coin with the Greek Goddess Athena on the obverse with an olive sprig, owl and initials of "Athens" on the reverse.

Cost of Peloponnesian War (Sparta vs Athens) 431–404 BC

The minimum number of men needed to defend Athens was 3,500 on land plus many more required to defend the surrounding sea. Soldiers were paid one silver coin per day (a silver drachma) 7,000 drachmas equaled "one talent"

The yearly total for funding the land army was around 420 talents. 420 per year x 7,000 drachmas totaled 2,940,000 drachmas per year.

For sea power (guarding the trade routes) it cost 1,580 talents per year. 1,580 per year x 7,000 drachmas totaled 11,060,000 drachmas per year. Drachmas were 3.64 grams each.

The grand sum for Athen's land and sea military totaled 14,000,000 drachmas per year. Considering the operating Gold / Silver ratio during this era was a military budget of $790,000,000 per year to to defend a population of 370,000.

Adjusted per capita, in today's USA military budget terms, that would be equivalent to USA military spending of $711 Billion dollars per annual.

In the chart below it's fascinating to see the historical comparison. Athens was spending on military per capita a little less than USA spends today. Note that USA spends more on defense than the next 11 countries combined. The other comparison is that in both in ancient Athens and modern USA neither place had the tax revenue to justify this type of expenditure. This is a major reason why USA is 30 Trillion in debt w/ 164 Trillion in unfunded liabilities (social security and medicare unfunded)

During the Peloponnesian War, the Athena Temple functioned in much the same way as a modern bank to fund the Athenian war. The bank vaulted physical silver from nearby silver mines. By 428-427 BC, the fourth year of the war, the temple reserve had fallen to low inventory. To compensate for the dwindling fund, the Athenian government introduced a direct tax on the people, which proved to be very unpopular. Athens had calculated that their opponents didn't have enough resources to go three years but the war dragged on for 27 years.

Tax revenue did not bring in the revenue to fund the war so Athens started debasing their currency by adding copper to the coins. They were so desperate that they even started melting down their statues but that didn't buy much time. Athens went broke. Athens ran out of money to fund soldiers outside the city walls and inside the city walls they were devastated by a plague.

From Mike Maloney's 7 stages of Empire Video. Video is programmed to begin at the 5:14 marker. First time in history where there was evidence of money printing or currency debasement to pay for war.

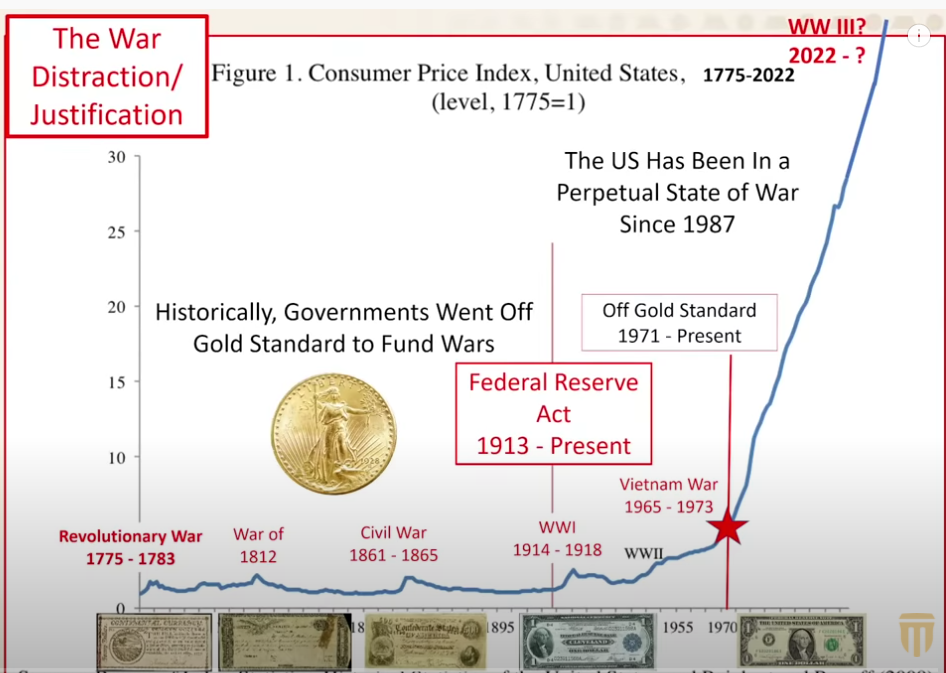

Currency debasement & war in the past 100 years.

During WW1 and WW2. USA receives gold. Europe receives consumer goods, grains and oil.

Allied powers defeat Axis powers in WW2 because USA supplied approximately 70% of Global oil production - Chart by Steven St. Angelo of SRSrocco REPORT https://srsroccoreport.com/

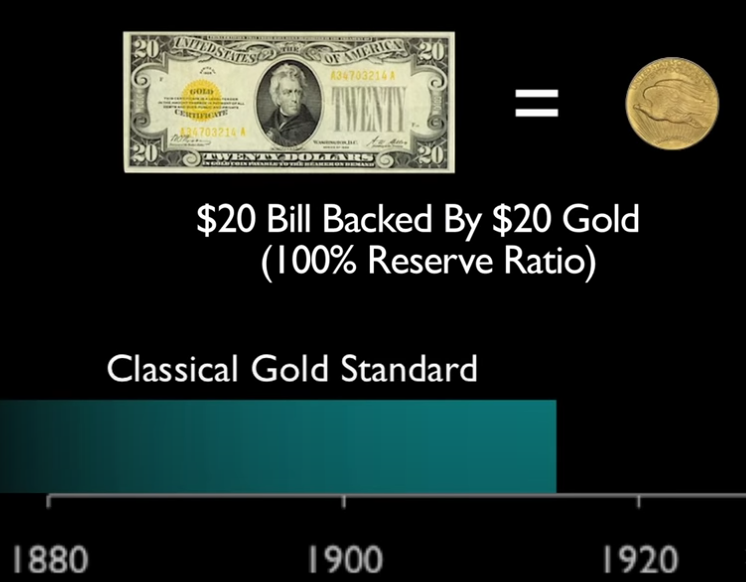

US Dollar, Enjoys an era with a 1:1 gold to paper ratio. The Classic Gold Standard ending prior to the great recession.

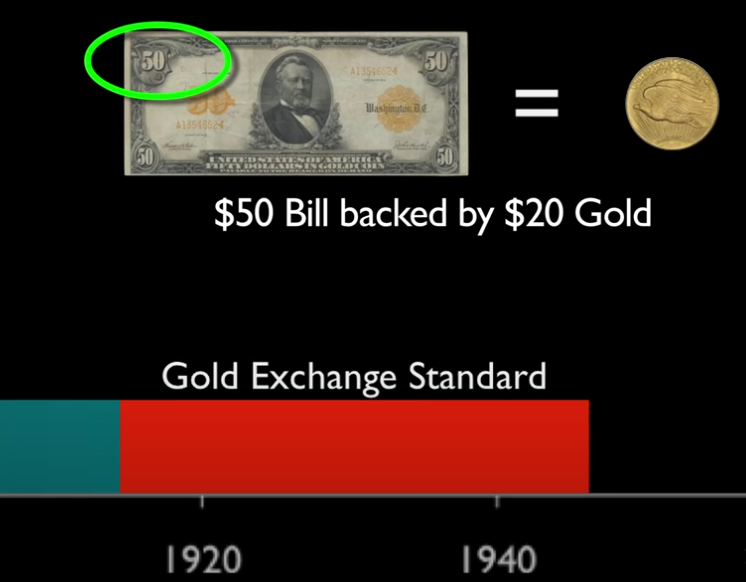

USA then starts debasing currency by 60%, a 30 year period.

1944 Bretton Woods agreement establishes USA as Global Exchange Currency. Soon after Bretton Woods USA starts wars with Korea and Vietnam. US corporate and economic prosperity is largely due to USA's global reserve currency status. To pay for wars USA prints and prints meanwhile shipping it's devalued paper money throughout the world in exchange for finished goods. The game is receive tangible finished goods in exchange for printed paper backed by faith.

privilège exorbitant in French refers to the benefits the United States has due to its own currency (the US dollar) being the international reserve currency.

For example, the US would not face a balance of payments crisis, because their imports are purchased in their own currency.

US spreads paper money all over the globe (international trade)

Lynette Zang (Chief Marketing Analyst ITM Trading.) Money printing to pay for war. Inflation rages out of control.

You’re Dead if you Defy the Petro dollar.

The French were the first to notice that the USA was printing (distributing paper all over the World)

Gold window closed in 1971

USA and The Saudis cut a deal – OPEC denominate all sales of oil in US dollars. USA provides security for Saudi Arabia.

From that point, every other nation that needed to buy oil had to first hold US dollars which meant that they exchanged their goods and services for US dollars (some speculate which the Americans just printed)

(some speculate) The Americans brought their oil for close to free by printing those dollars. The ultimate free lunch for the Americans at the expense of the rest of the world.

In 2000 Saddam Hussein started selling Iraq's oil directly for the Euro bypassing the cozy arrangement the Americans had with OPEC.

USA concocted a pretext to wage war ( aka 9/11, twin tower blast) Invading Iraq reverts sales of oil back to dollars. The currency crisis was temporarily skirted.

USA invades Iraq 2003 , Hussein executed in 2006

In 2008 , Iran's President Ahmadinejad reiterated his view that oil should be sold in a basket of currencies rather than dollars

In 2009, Colonel Gaddafi, then President of the African Union, suggested to the States of the African continent to switch to a new currency, independent of the American dollar: the gold dinar. The objective of this new currency was to divert oil revenues towards state-controlled funds rather than American banks. In other words, to stop using the dollar for oil transactions. Countries such as Nigeria, Tunisia, Egypt and Angola were ready to change their currencies. Unfortunately in March 2011, the NATO-led coalition began a military intervention in Libya in the name of freedom. Date of assassination: October 20, 2011

Hugo Chavez (Venezuela President) also started selling Venezuelan oil for currencies other than dollars. There were a number of attempts on his life and "regime change", traceable right back to the CIA.

Axis of Evil ( USA propaganda to describe Iran, Libya, Venezuela exiting the petro dollar)

Saddam Hussein executed in 2006. Killed for selling oil for Euros.

2022 War in Ukraine

USA is printing. Russia is not printing. USA has 200 Trillion debt. Russia has little debt. Russia is a commodity superstore. USA is a commodity consumer. Europe needs Russian oil. Europe needs Russian natural gas. China and Russia have tons of gold. India already stepped up to purchase tons of silver. India has signaled it will purchase Russian oil outside of US dollars.

So the US itself, in another massive strategic blunder, will speed up de-dollarization. As the managing director of Bocom International Hong Hao told the Global Times, with energy trade between Europe and Russia de-dollarized, “that will be the beginning of the disintegration of dollar hegemony.” Moreover, US banking supergroups like JP Morgan and Citigroup sum up their collective fears,

“Booting Russia from the critical global system – which handles 42 million messages a day and serves as a lifeline to some of the world’s biggest financial institutions – could backfire, sending inflation higher, pushing Russia closer to China, and shielding financial transactions from scrutiny by the west. It might also encourage the development of a SWIFT alternative that could eventually damage the supremacy of the US dollar.”

Putin and Xi Jinping Plot their SWIFT Escape Source - Pepe Escobar, "How Russia will bypass western economic warfare" https://thecradle.co/Article/columns/7385

Trade, Credit, Debt & Settlements. History and Deficit Financing. THE MYTH OF BARTER

Exchange is a relationship between two equal partners where they, based on reciprocity, give each other an equivalent, either immediately or over time. If the transaction is not complete, there's a debt, but once it is complete they're equal.

Over 5,000 years ago, since the beginnings of the first agrarian empires, communities and political leaders have used elaborate credit systems to buy and sell goods. It is in this era that we also first encounter a society divided into debtors and creditors—which lives on in full force to this day.

Modern nations run on deficit financing; consumer economies run on debt; international relationships are all about debt.

There are thousands of articles written on the origin of money. Most of these stories follow a similar path. They claim that humanity lived peacefully for tens of thousands of years but barter was impractical mostly because two parties would have trouble agreeing on equal values.

The Myth of Barter. There has never been a society where the majority of goods were distributed by a system relying on the 'double coincidence of wants'. Here is how the myth is typically trotted out. The classic example is Villager A has a cow and Villager B has chickens. Does 40 chickens equal a cow or is it more like 45 or 50? Barter is considered inefficient because in the complex material world of livestock, agriculture, furniture, hardware, fixtures, jewelry, goods, services the balance of equal exchange is impossible to standardize and leads to bickering & confusion.

The story continues that money was invented as a medium of exchange which led to an explosion of trade and prosperity. Though I have great respect for great thinkers like Adam Smith, David Ricardo, John Maynard Keynes, Milton Friedman, Ray Dalio, Mike Maloney & other scholars of economics. ...I respectfully disagree with them all.

Gold and Silver coins were first developed in Lydia around 600 BCE. I believe that physical money was not invented as silver and gold coins to replace barter as popularized by every economics 101 class. Instead here is the Precious Metals Warfare Theory. #PMWT

Money was not created as a medium of exchange but was invented to pay soldiers. Thus cash markets first originated right around where armies were located. If you had an army of 50,000 men they all need food, clothes, boots, supplies, swords, shields, helmets, wine, women, & entertainment. Either you have to employ another 50,000 people just bringing stuff to the soldiers or you pay the soldiers in silver. Soldiers hung out on the outskirts of town guarding the village and engaged in war and thus needed "a lot of waking around money."

This is the beginning of modern trade. A huge sector of the population exchanging goods made in the kingdom for the silver held by the soldiers. Your population has predictable income stream from the silver coins paid to soldiers.

Then in history (Sparta, China, Rome, Persia, et al) merchants have a unique relationship with war trade. The silver and gold coin was not invented to replace wonky barter but silver coins were used to pay soldiers.

The Axial Age - Emergence of Greek Philosophy and World Religions. Karl Jaspers, the German existential philosopher described the period from 600 BC to 600 AD as "the Axial Age." Jaspers pointed out that almost all major schools, both of world philosophy and the great world religions, spring up in this relatively short period of time. If you extend it from 600 B.C. to 600 A.D. Greek philosophy starts happening exactly the times and places where they invent coinage. This all occurs precisely during the same time period and in the same city, Miletus Greece.

Miletus is the first city where they're using coins in everyday transactions. Miletus is the home of Greek philosophy at exactly the same time. Similar patterns emerge in the Genghis valley of China and India.

World religions arise largely as peace movements against these empires that are using the coins originating as soldier salaries. Here is a metaphor or event told in the bible. Whether the event really happened isn't germane because it still represents a learning opportunity for everyone regardless of religious belief(s.) Jesus the historical figure objected to what the coins represented, the war machine. Moreover, the trade associated with war favored the bankers, merchants, political class & soldiers leading to wealth concentration thus shoving the disadvantaged into deeper poverty. The Prince of Peace drives the money changers out of the temple. The temple as reported earlier was the bank where silver was stored. It was "the bank."

People have talked about Axial Ages as being characterized by a military coinage complex.

Today you've heard the term "military industrial complex." The Peace movements in all the World's Religions call for forgiveness of debt. In the Judaeo Christian teachings this periodic forgiveness of all debt is called "The year of Jubilee." - In the Hebrew Scriptures, the jubilee was to be a time to free slaves, to return land to its rightful owners, and to forgive debts. https://www.usccb.org/resources/jubilee-call-debt-forgiveness

Source: Towards an Anthropological Theory of Value, David Graeber

How the Athena Temple functioned like a bank.

Athena Temple, The First Bank of Greece. (same banking practice spreads throughout Greco-Roman World)

Funds were taken from the Athena Temple was very much like how similar financial transactions are conducted today with banks. It was typical for the Athena Temple to give loans for building projects as well as military expeditions with a sliding scale interest rate. For instance, the city would take out a loan in a specific amount of talents to fund an expedition and would be charged one drachma per day for each talent loaned until the end of the financial year and one drachma a day for five talents after, which amounted to a reduction from 6% to 1.2% interest. The system was of course quite ahead of its time and very efficient and profitable, as long as there was a constant injection of silver into the reserve.

Source, How Did the Athenians Fund Their Military during the Peloponnesian War? DailyHistory.org Later in time Alexander's Army took half a ton of silver a day to pay the army. (To be continued)

Comments