Military operation in Ukraine and Fundamental Value of Gold

- rickshawagency

- Apr 25, 2022

- 2 min read

Updated: Apr 27, 2022

April 25, 2022

No one has a crystal ball so the only reliable way to offset uncertainty is

to look far back into the past and gain insights into the future.

The special operation in Ukraine will result in the following:

New Maps will be drawn in the area we used to call Ukraine.

Natural Resources will be distributed differently.

Wealth will be distributed differently.

The way international trade is conducted will be drastically altered.

How does this impact Gold?

Russia has been saving gold for decades and encourages its citizens to do the same.

Russia's ruble is backed by natural resources like oil, gold, palladium, nickel, aluminum, gas, coal and wheat.

The US and Europe are printing money, have negative interest rates & weak manufacturing sectors.

Russia has very little debt, is not printing and has raised interest rates to fight inflation.

The US Government and their banking partners can not admit gold has value. They fear it would interfere with their lust for power and control.

The US dollar is becoming worth 25% less year over year.

Cost of this war goes well beyond adding up the buildings bombed and cost of military expenditures. The US dollar will be ousted as the national reserve currency. Nations, retirement accounts and traditional financial instruments will be damaged beyond recognition.

Whenever economies collapse and producer price indexes are north of 25% gold steps up and does the accounting to return to a baseline.

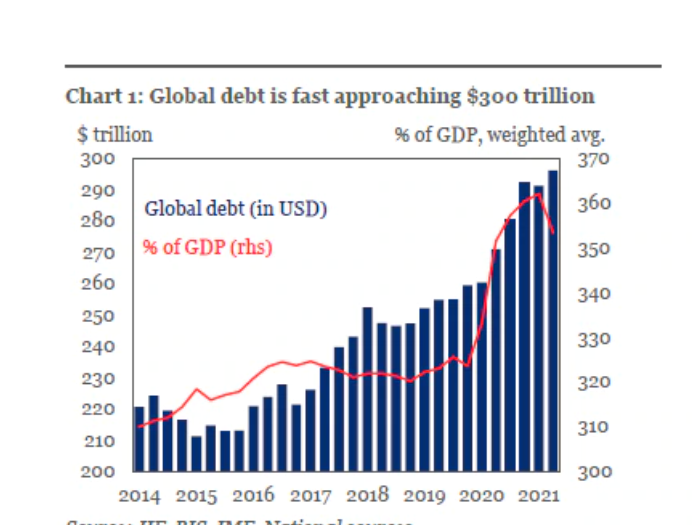

The formula used to return to baseline is total debt divided by above ground gold stock Global Debt = $303 Trillion (first graphic below)

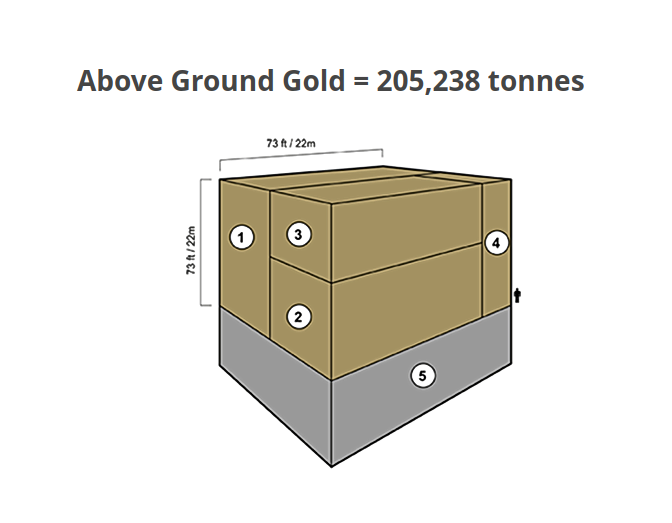

Above ground gold stock 205,235 metric tonnes (second graphic below). There are 35,274 ounces per metric tonne.

There are only 7,239,565,212 ounces of gold in the world. Gold is finite. Gold is transferred in exchanges, sales, looted during wars (Roman wars, Chinese Dynasties, Crusades, Monarchs, Cortes, Pizarro, Nazis, Sudan, Iraq, etc) Gold is transferred via inheritance, Gold is vaulted, Gold is gifted (jewelry) But all the gold ever mined is still in existence (w/ some loss in electronics, aerospace, shipwrecks but this loss is statistically insignificant)

Here is the math: 303,000,000,000,00 debt divided by 7,239,565,212 ounces

Fundamental Value of Gold is $41,853.00 per ounce

divide graphic 1 above by graphic 2 below

Earlier this month, the Bank of Russia announced a fixed price for buying gold with rubles. It set a price of 5,000 rubles ($66.84) for a gram of gold.

From SD Bullion website "Juerg Kiener drops a bombshell for viewers of Bloomberg Asia. In the six-minute interview, I subtitled it for you. Mentioning how outsized silver futures and options leverage in the hundreds of paper ounces versus one-ounce physical silver helps maintain the illusion that all is calm in the silver market. It's not, and he describes in detail about silver supply-side pressures building at the moment.

According to Kiener, gold bullion at these spot price levels is also the bargain of the Century. Perhaps have a few viewings on why the metals markets are his primary concern.

Kiener is also on record, stating that five-figure gold price stabilization is needed in a new currency realignment to help stabilize the world economy."

Comments