Why The USA's "privilège exorbitant" will cease to exist. Precious Metals Warfare Theory addendum

- rickshawagency

- Apr 2, 2022

- 5 min read

Updated: Jun 23, 2023

April 02, 2022 Editors Note - All wars including the war in Ukraine are tragic. The views expressed in this article do not support any side of this war. The intent is to show some historical patterns and indicate some perspectives mainstream media ignores.

Backstory In 1944 via Bretton Woods U.S. dollars were convertible to gold between countries. This yielded "America's exorbitant privilege" because it created an asymmetric financial system where foreigners see themselves supporting American soaring living standards and subsidizing American multinationals. As American economist Barry Eichengreen summarized, "It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one."

In February 1965, President Charles de Gaulle announced his intention to exchange its U.S. dollar reserves for gold at the official exchange rate. He sent the French Navy across the Atlantic to pick up the French reserve of gold and was followed by several countries. This was a run on gold or a bankrun.

Gold Window Closes This resulted in the threat of depleting U.S. gold stock and U.S. economic influence. So President Richard Nixon ended the convertibility of the dollar to gold on August 15, 1971 (the "Nixon Shock"). Mike Maloney, in his history of money series, stated he was shocked Nixon wasn't killed for this criminal act.

Petro-Dollar Opens

As a result, confidence in the Dollar eroded. In 1974, the price of oil was skyrocketing, partly due to inflationary policy by the Federal Reserve, and partly due to an Arab oil embargo in response to US aid to Israel. USA and Saudi Arabia negotiated a deal that the Saudis would price oil in Dollars. Behind these negotiations was a not so subtle threat to invade Saudi Arabia and take the oil by force. But the Petro-Dollar plan worked brilliantly and the invasion never happened. Source - Jim Rickards article in "The Daily Reckoning"

The USA bullied Saudi Arabia (USA has the guns) into the Petro-Dollar plan. This was like a prison yard deal. Think of two prisoners in which the alpha prisoner says to the weaker prisoner, "I will give you protection but you will do what I want you to do."

Precious Metals Warfare Theory.

Wars have an aggressor seeking resources. The aggressor is financed by an Emperor, Czar or King. The victim has to surrender natural resources, (gold, silver, copper, farmlands, oil, etc) The victim is also either enslaved or coerced into cheap labor.

Rome expanded for gold, spices, lumber and their soldiers were paid in gold and silver. The emperor of the Aztec empire Montezuma had amassed tons of gold and their empire stretched as north as Utah. The Aztec Empire came to an end at the hands of Conquistador Hernan Cortes. Cortes and his soldiers incentive to colonize Mexico was their payment in gold and silver. They were financed by the King of Spain so they did kick some gold/silver back to Spain for the sake of optics but the amount they kept will never be known.

Think of a crooked cop arriving first at a crime scene where rival drug trade members shoot it out. How much of the cash & cocaine goes to the evidence room? How much does the crooked cop keep? We will never know but ask the ordinary citizen in Latin America how much fear they have towards law enforcement.

While Cortes was looting Mexico Francisco Pizarro conquered the Inca Empire. The Incas consisted of present-day Peru and Ecuador, and parts of Chile, Bolivia and Colombia. Within 20 years, the Inca Empire was in ruins and the Spanish were in undisputed possession of the Inca cities and wealth. Peru would continue to be one of Spain's most loyal and profitable colonies for another three hundred years.

Atahualpa believed that once the Spanish received their ransom of a room full of gold for his release, they would leave and not bother the Inca any more. Guess what, A blackmailer never goes away.

Significant learning moments shown in 7 graphics over the last 259 years.

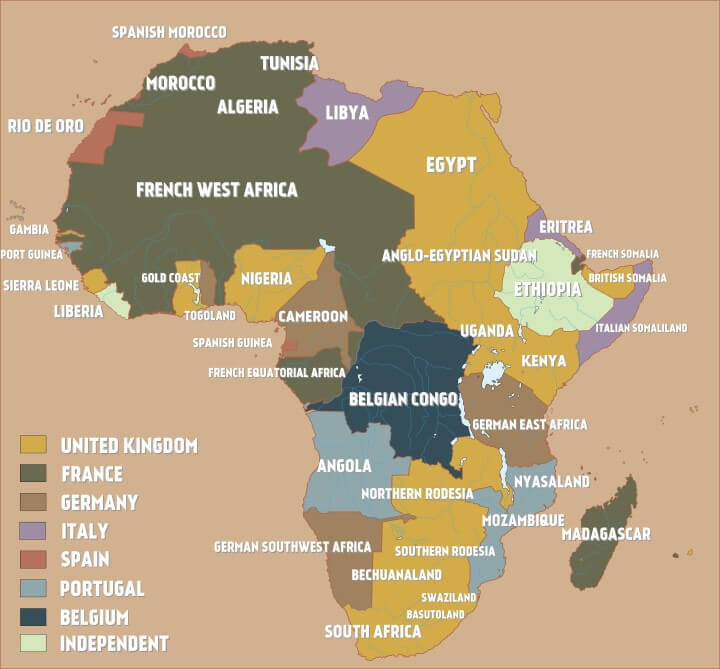

Notice how all of Latin America and all of Africa have abstained from sanctions.

Notice how Africa and Latin America were carved up by European nations.

Notice how much Gold is in Latin America and Africa.

Notice Russia's commodity superstore and the reach across other nations.

Notice how Russia's energy has backed the ruble. Look how quickly the ruble restored its' value against USD despite sanctions. Right now the narrative has focused on natural gas for rubles but once Russia rolls out the same plan for their oil, wheat, coal, fertilizer, aluminum, palladium, nickel , sunflower oil, geez. Moreover, Russia has so much more gold than people realize. China and Russia have been setting themselves up for past 5 years.

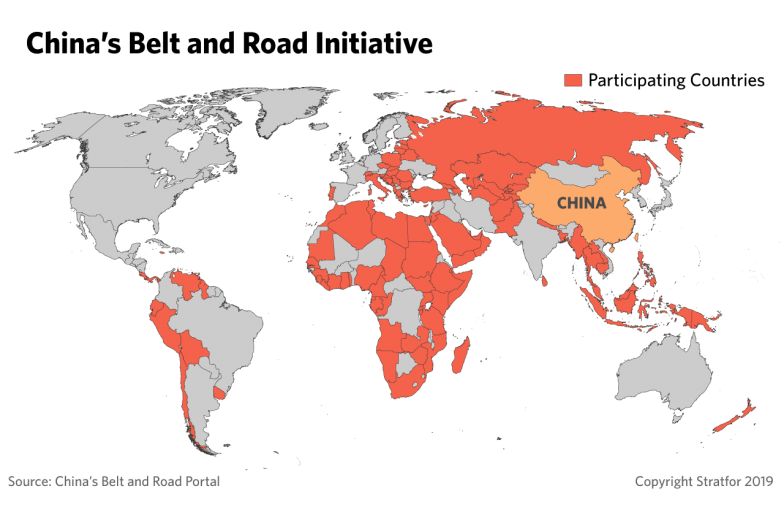

Notice the nations participating in China's Belt and Road Project.

Tom Lewis wrote the following in February of 2018, "With history being the best indicator of the future, America is primed for another currency collapse. We are facing a debt as out-of-control as Weimar Germany while the government keeps the printing presses busy. At this time, China and Russia are supporting their respective currencies with gold. In addition, both countries are using a new money transfer system, CIPS (China International Payment System), to replace the western SWIFT (Society for Worldwide Interbank Financial Telecommunication) system."

Picking sides. US dollar or New Reserve System?

The majority of emerging markets are sitting on the sidelines while the war in Ukraine continues. Even if a country hasn't officially declared their loyalty regarding the war in Ukraine they are positioning rapidly. Brazil's central bank more than quadrupled its foreign reserves in Chinese yuan last year. Brazil likewise has trimmed holdings of U.S. dollars and euros. Almost every objective economic analyst like Luke Gromen had signaled as soon as the word sanctions were uttered that these sanctions have unintended consequences and there is always a "workaround."

In the Ukraine war context the sanctions didn't punish Russia, they punished the US Dollar and bolstered Russia. #SelfInflictedWound

This rush to Russia & China's currency alliance (Pepe Escobar coined the term "Rublegas") by BRICS and rest of the world is by far the biggest policy blunder committed by US & Europe

Team USA and Europe vs Russia. Russia is winning and USA/Europe are losing.

Compare the market power of China, India, South Africa, Brazil, Iran, Turkey, Saudi Arabia and I would argue majority of Africa and Latin America against USA and Europe.

Moreover, (refer to the very first map above) neutral nations like Mexico, Peru, Argentina, Chile, Ghana, Sudan, Indonesia, Kazakhstan, Uzbekistan and others are leaning towards alternatives to US Dollar. The thinking being the US dollar reserve has done nothing for our nation and everything for USA. Nations don't forget how they were exploited by Europe during colonialism and USA during neo-colonialism.

Russia made a deal to sell oil to India which is three times EU population. Not to mention natural gas deal with China which is three times EU population.

Conclusion - In the past month an alternative to US dollar has emerged. Yes the war brought this into light but this arrangement has been going on for over 5 years.

The US reserve currency tries to suppress the value of gold and silver while the Russian Ruble will be supporting the value of gold and silver.

Next article we will do a deeper dive into my Precious Metals Warfare Theory and look at the country of Sudan and how their gold plays into this theory.

First article on Precious Metals Warfare Theory

Comments