Feds Seize $3.6 Billion in Bitcoin Hack. Gareth Soloway calls BTC crash to $17,000 & Gold Breakout

- Silver Soaring

- Feb 10, 2022

- 2 min read

Updated: Jun 23, 2023

Soloway shows KITCO how gold will outperform S&P 500, Nasdaq & Bitcoin in 2022. Watch Soloway's distinctive technical analysis on Bitcoin's dive to $17,000.

Last night on KITCO Gareth Soloway explained to KITCO reporter David Lin why Bitcoin will crash to $17,000 level. David Lin was taken back because he had witnessed some previous analysts calling out $100,000 Bitcoin so he asked Soloway, why a drop of 83% ?

Lin wondered why Soloway was so confident in this monstrous Bitcoin crash. Watch the video below and see Soloway smacking these forecasts back to earth.

Soloway is a legendary swing trader, President, CFO, Chief Market Strategist for In the Money Stocks. He also runs a crypto venture called Verified Investing Crypto

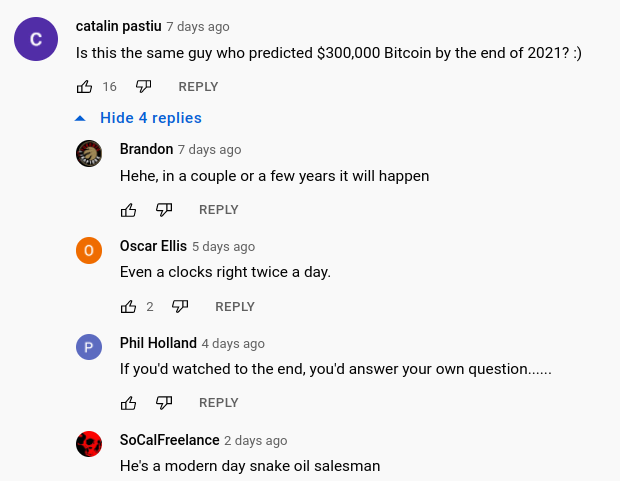

Gareth Soloway warns traders to have no emotional connection to an asset. Though he runs a crypto trading firm, he has no conflicts of interest nor is he a shill for Bitcoin like Michael Saylor, Alex Mashinsky, Tony Scaramucci, or their grand philosopher Robert Breedlove who embarrassed himself last week on KITCO as hundreds of comments flooded in mocking Breedlove with, "Isn't this the same guy who called for $300,000 Bitcoin by end of 2021" (screenshot at end of article)

Beginning at the 21:00 minute mark Gareth Soloway calls for the Bitcoin crash to $17,000 from November 8, 2021's $67,566. Let that sink in a downward crash from 67,566 to 17,000 and this from a crypto trader who is one the most sought after technical advisors (frequent appearances on Kitco, Stansberry, Bloomberg, Forbes, et al)

What about Gold? In video above Gareth Soloway explains why gold outperforms BTC, Nasdaq, S&P 500. Gold over ALL ASSETS

In yesterday's Soloway / KITCO video Soloway shows David Lin the breakout for Gold and how it moved 900% upward using historical context and technical charting last time inflation was raging. "Inflation is not just about price increases, price increases on everything are symptoms of the root of inflation, which is money printing." (75% of the money existing has been printed in last 18 months)

Silver Evaluations off the Charts

Gold to Silver ratio adjust upward surpassing historical statute of 15-1 Reddit's WallStreetSilver on CNBC, ( move over mainstream media, The Apes have arrived)

IMF in full panic mode or scheming mode?

Chaos in Global markets and a Run on the Banks.

Once "simulations" start it signals real events. Here Comes the Central Bank Digital Currency. High Alert

The USA debt reached $30 Trillion.

Currency and credit derivatives now exceed $612 Trillion.

Unfunded Liabilities such as social security and medicare are over $164 Trillion.

This represents a liability per citizen at over $464,000.

Clearly, The Fed should have stopped purchasing assets and given a clearer signal on rate hikes.

The Fed is not in control of the inflation narrative.

The Fed is not in control of the rate narrative.

The Fed has lost all credibility and most experts believe they will start another round of QE in 2022 to answer the market's "hissy fit."

Now there are so called "Cyberattack Simulations" as precursor to rolling out the Central Bank Digital Currency. Some speculate Bitcoin assets vanish into thin air to help fund CBDC Is this another conspiracy? Don't ask me ask Forbes reporting

On Breedlove's KITCO appearance the same day 3.6 Billion in Bitcoin was seized by Feds.

Comments